pay indiana state tax warrant

If your account falls into the collection process it is important to understand each billing stage and its deadline. Payment may be made in person at the Spencer County Sheriffs Office or by mail.

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)

Berrien County Treasurer S Office Warns Residents Of Scam Letter

E-Tax Warrant Search Services.

. Saves you time paper and postage. If your account reaches the warrant stage you must pay the total amount due or accept the expense and consequences of the warrant. Payment by credit card.

ATWS is a software package that streamlines the handling of Indiana Tax Warrants. Mail - Payable to. See Advantages of ATWS over Paper.

Find Indiana tax forms. Property that is illegal to possess. For more information call 317-232-2240.

Have more time to file my taxes and I think I will owe the Department. You can set up a payment plan with the Indiana Department of Revenue by calling 317-232-2165 or visiting wwwintaxpayingov. Tax warrant payments can be mailed money order or cashiers check to the Sheriffs Office or paid online using the following website.

Based On Circumstances You May Already Qualify For Tax Relief. Doxpop provides access to over current and historical tax warrants in Indiana counties. Have more time to file my taxes and I think I will owe the Department.

How do I pay a tax warrant in Indiana. That process begins when the DOR mails tax warrants to Clerks who hand write the information in a Judgment Book and mail back filing information to the DOR. Find Indiana tax forms.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Hamilton County Sheriffs Office 18100 Cumberland Road. Although this is not a warrant for your arrest the information will appear on a credit report or title search and becomes a lien on your property.

Our information is updated as often as every ten minutes and is accessible 24 hours a day 7 days a week. A service fee will be charged. Our service is available 24 hours a day 7 days a week from any location.

A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes. Ad See If You Qualify For IRS Fresh Start Program. Know when I will receive my tax refund.

2 Make no representations regarding the identity of any persons whose names appear in the information. Eligible taxpayers may request a tax warrant expungement for tax liabilities that have been resolved through the Indiana Department of Revenue DOR. Office of Trial Court Technology.

Tax warrants that remain unsatisfied are returned to the Department of Revenue for further action resulting in additional costs to the taxpayer. Per Indiana Code 35-33-5-1 a search warrant can be requested and issued to search a place for any of the following. Claim a gambling loss on my Indiana return.

However circuit clerks using the INcite e-Tax Warrant application or otherwise receiving the warrants electronically do not need to record tax warrant judgments in the county judgment docket because an electronic tax. Know when I will receive my tax refund. Doxpop LLC the Division of State Court Administration the Indiana Courts and Clerks of Court the Indiana Recorders and the Indiana Department of Revenue.

Take the renters deduction. Take the renters deduction. Find Indiana tax forms.

Depending on the amount of tax you owe you might have up to 36 months to pay off your tax debt. Pay my tax bill in installments. Please arrange to pay by cashiers check money order or cash.

To let us know that you would like to subscribe to e-Tax Warrant Search Services mail the completed User Agreement to. Implement the 25 Sheriff Process Fee for Tax Warrants. Lieberman Technologies is proud to provide Indiana Sheriff offices with Automated Tax Warrant System ATWS.

A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to collect the money owed. And 3 Disclaim any. Property that constitutes evidence of an.

What is a tax warrant. Make a payment online with INTIME by electronic check bankACH - no fees or debitcredit card fees apply Make a payment in person at one of DORs district offices or downtown Indianapolis location using cash exact change only personal or. 1 Do not warrant that the information is accurate or complete.

Claim a gambling loss on my Indiana return. Illinois Street Suite 700. Know when I will receive my tax refund.

No personal or business checks are accepted. Under IC 6-81-3 and IC 6-81-8-2 DOR will review requests for tax warrant expungements if the warrant was issued in error or the liabilities have been resolved and expunging the tax warrant may be in the best interest of the. Property is possessed by a person who wishes to use it to commit a crime or hide it to prevent the discovery of a crime.

Pay my tax bill in installments. The card owner may call 1-888-604-7888 to process the payment refer to Payment Location Code. Occasionally it is necessary for the Indiana Department of Revenue DOR to issue bills for unpaid taxes.

Tax Warrant Payment Methods. Continue recording tax warrant judgments in the judgment docket if not received electronically see IC. Almost one third of Indiana counties were processing tax warrants manually when this project started.

The DOR also sends the Clerk a check for 300 for each tax warrant filed. User Agreement for e-Tax Warrant Search Services. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Free Case Review Begin Online.

Application For Renewal Of Alcoholic Beverage Permit 47 Pdf Fpdf Doc Docx

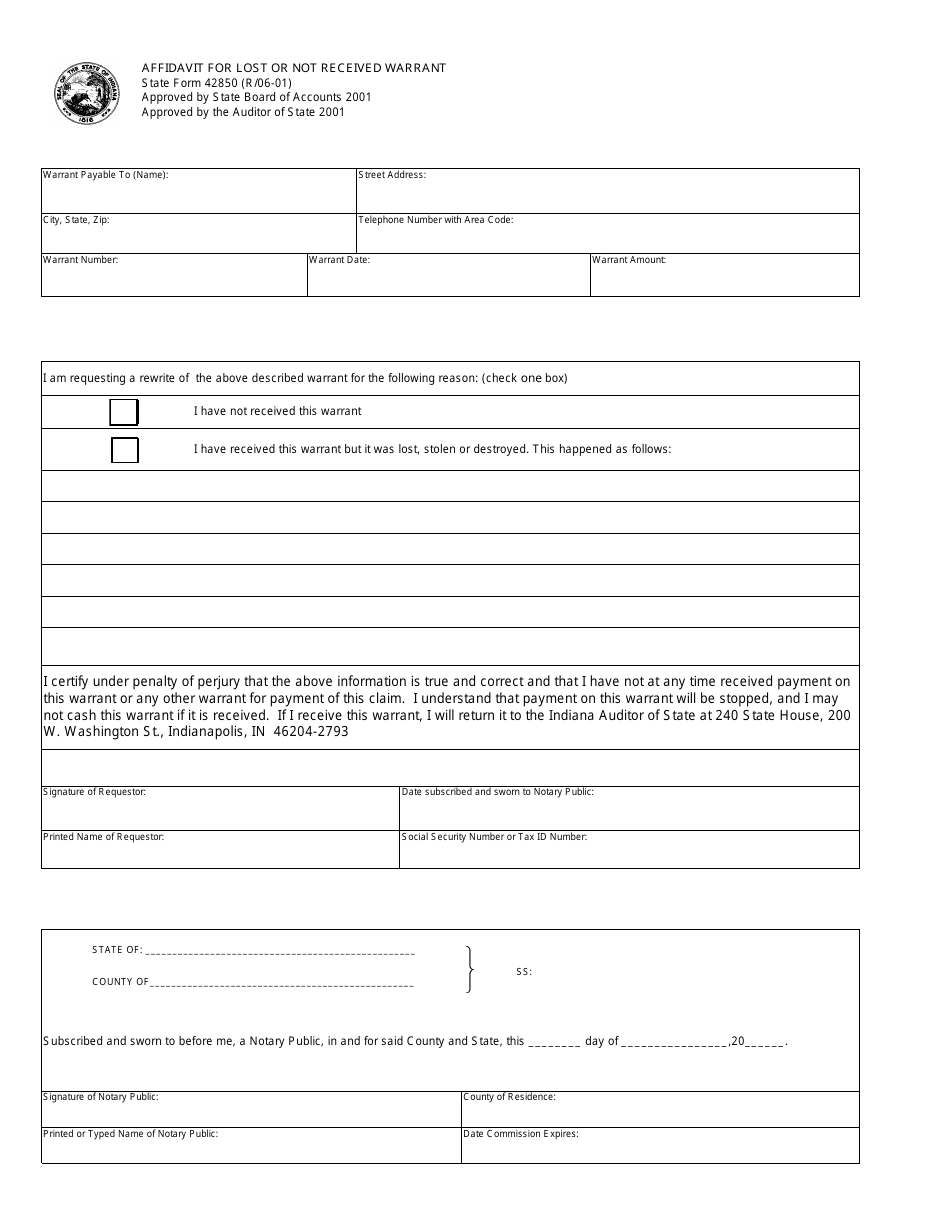

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant Indiana Templateroller

Unfortunate But Familiar Indiana Dwd Warns Of Rise In Unemployment Fraud Wane 15

Dor Owe State Taxes Here Are Your Payment Options

Dor Make Estimated Tax Payments Electronically

State Of Legal Residence Vs Home Of Record Military Com

Dor How To Make A Payment For Individual State Taxes

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)

Berrien County Treasurer S Office Warns Residents Of Scam Letter

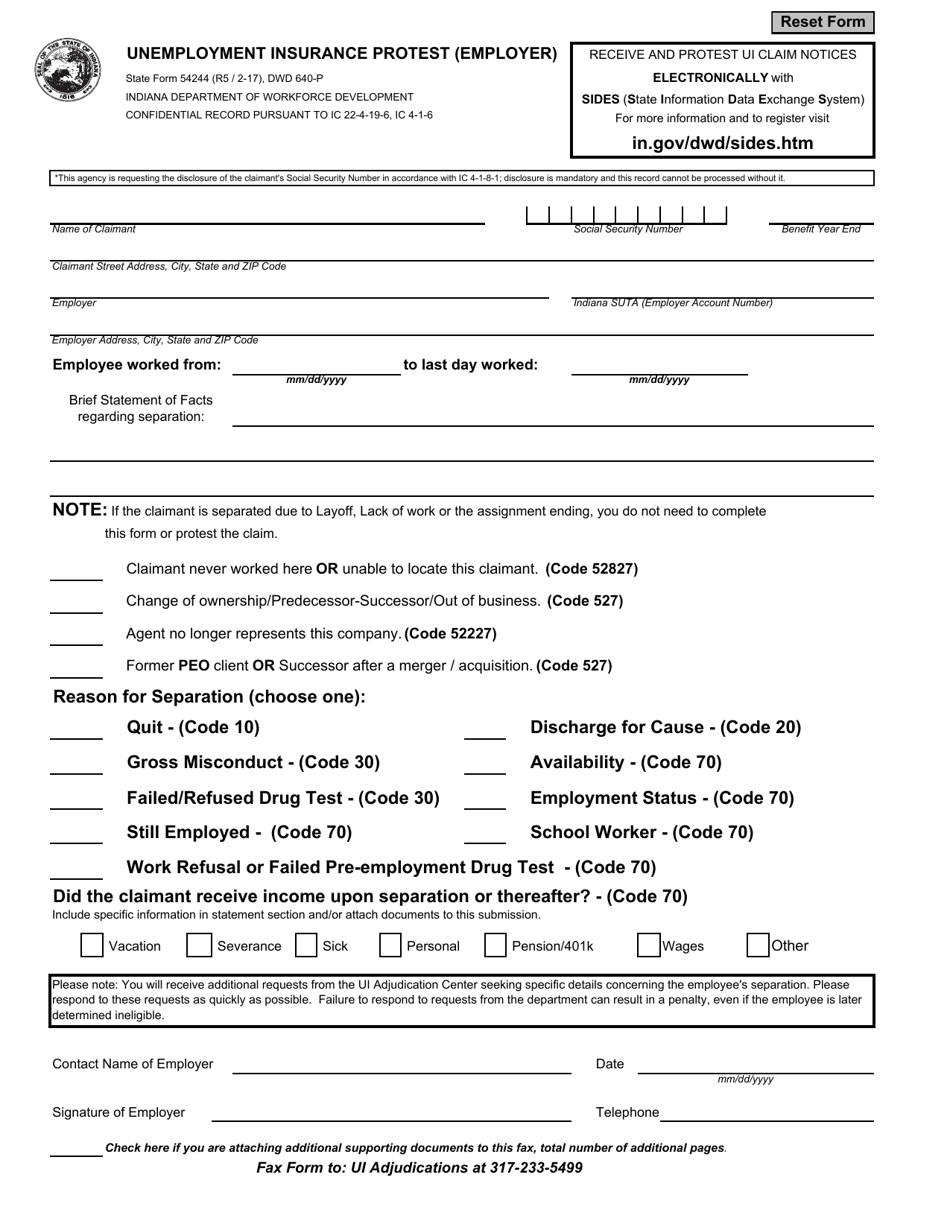

State Form 54244 Download Fillable Pdf Or Fill Online Unemployment Insurance Protest Employer Indiana Templateroller

Tax Refund Millions See Extra 125 After Filing Taxes Fingerlakes1 Com

Tax Warrant Scam Is Hitting Central Indiana Wthr Com

Dor Requesting An Extension Of Time To File Via Intime

Enforcing A Judgment Across State Lines Law Office Of Seth Kretzer

Dor Owe State Taxes Here Are Your Payment Options

A Fourth Stimulus Check From Your State Check The List Of Covid Relief Payments